The courage of building together

(2016 - 2017 - 2018)

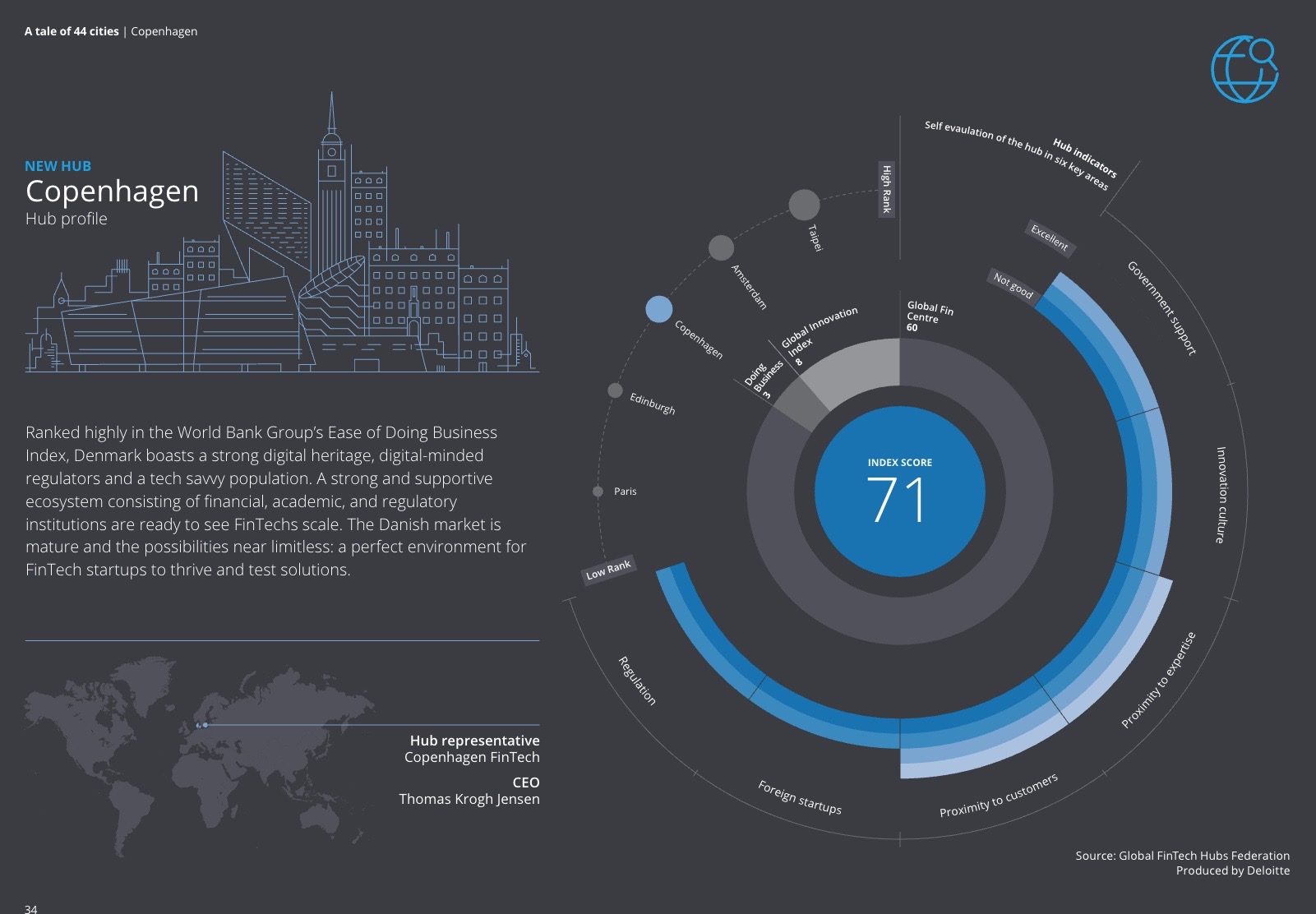

In 2016, a group of early partners placed a bold bet on what would become a decisive moment for Nordic fintech: the creation of an ecosystem builder like Copenhagen Fintech, designed to institutionally support a tech vertical which, at the time, existed largely on the margins of European finance.

FinansDanmark, Finansforbundet, Københavns Kommune, SDC, NETS, Sparekassen Sjælland & Spar Nord where the frontrunners that chose collaboration as the starting point: bringing startups, incumbents, ivestors, regulators, and talent into the same water-font building, now known as the Copenhagen Fintech Lab.

With Chainalysis and CrediWire as the first residents, more startups made the Lab their home, while across the Nordics Enfuce launched in Finland, early crypto, payments, and digital finance ventures emerged, and Copenhagen Fintech’s first international delegations signalled a clear ambition: Nordic fintech had global ambition from the start.

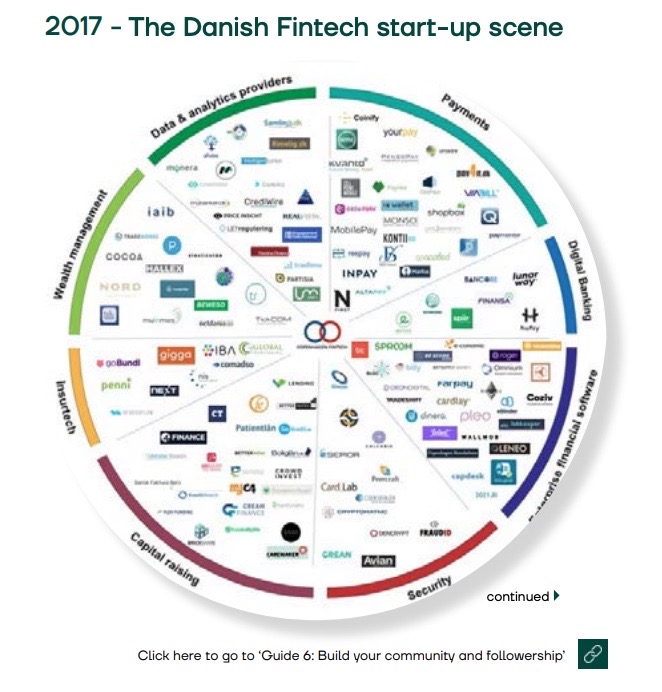

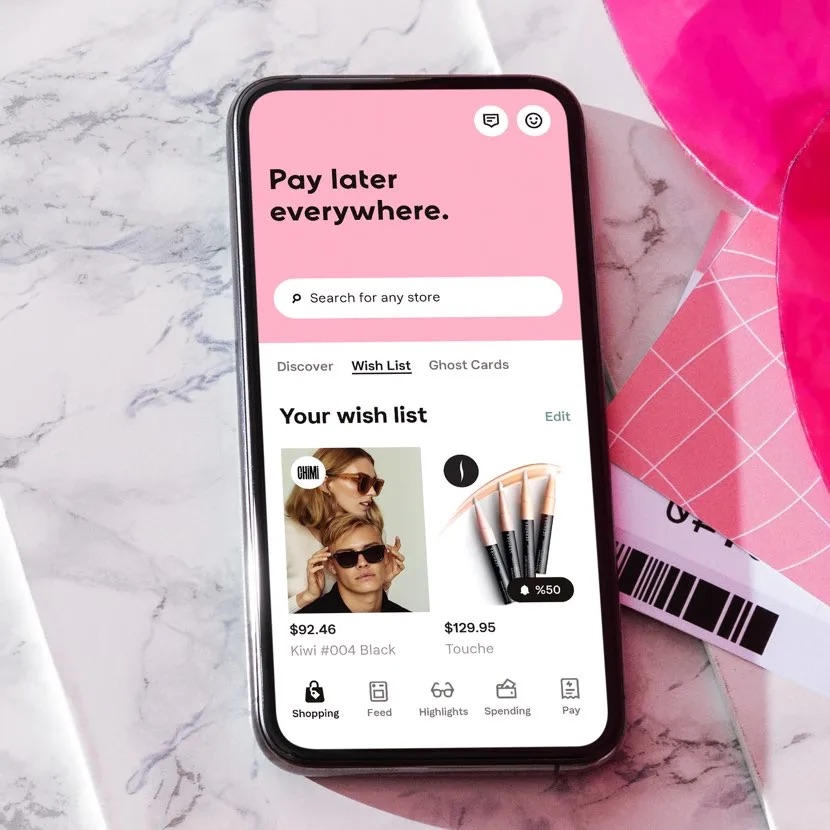

By 2017–2018, the ecosystem began to take shape through tangible signals across the region. Klarna received a banking license, MobilePay became national infrastructure in Denmark, Vipps BankAxept and BankID merged in Norway, reshaping the payments landscape.

The first local fintech mapping exercises made the ecosystem visible, Copenhagen Fintech Week launched as a shared meeting place, and Nordic fintech exits and unicorns such as iZettle and Tradeshift proved that scale was possible.

Scaling and proving the Model

(2019 - 2020 - 2021 - 2022)

This period validated what is now widely recognised as the Nordic model for fintech growth: trust-based regulation, strong public-private collaboration, incumbents acting as partners rather than opponents, and global ambition from day one.

These were the years where the Nordics were proving that they didn’t just launch fintech companies, they were building digital infrastructure.

National solutions like MitID illustrated how technology, regulation, and trust could and should work together at scale.

Collaboration became the defining keyword, with Nordic Fintech Week serving as the stage where the ecosystem came together to share knowledge, challenge assumptions, and learning from one another. The result was an explosion of partnerships, investment, and talent.

Danish fintech employment surpassed traditional financial sectors, funding volumes accelerated dramatically, and Nordic fintech companies increasingly moved from promising startups to system-critical platforms.

Maturity, infrastructure & geopolitics

(2023 – 2024 –2025)

From 2023 onward, the context changed fundamentally, with fintech becoming strategic - not just economically, but geopolitically and societally. The sector now sits at the intersection of increasingly complex regulation, and accelerating technology, as Europe seeks to build a digitally sovereign financial infrastructure and allocate sufficient capital to compete on the global tech stage. With visible concrete milestones such as Nordics leading fintech regional competitiveness, Companies like Qred moved from fintech challenger to licensed bank with Nordic reach, while scale-ups such as Flatpay, Uniify, and Januar secured significant growth capital to expand internationally.

At the ecosystem level, Copenhagen Fintech deepened its role as a connector, launching pan-Nordic programs, partnering with global technology leaders such as Microsoft, engaging new sectors like health and insurance, and strengthening ties to Asia through international delegations. The ecosystem evolved into a strategic layer of society. Open finance partnerships between banks and fintechs scaled across the Nordics. AI-driven compliance, ESG, and risk platforms matured. Embedded finance and payments became invisible infrastructure. Cross-sector collaboration expanded into health, insurance, energy, and the public sector - demonstrating that fintech’s impact reaches far beyond financial services alone.

By 2025, major exits, IPOs, and consolidations - including Klarna’s public listing, Flatpay’s unicorn milestone, and strategic acquisitions - coincided with the launch of Recommendations for a National Fintech Strategy for Denmark and the Nordic Fintech Center, marking a clear transition: Nordic fintech had matured from a growth story into a strategically important layer of economic and digital sovereignty.

Where do we go from here

If Denmark and the Nordics are to maintain global competitiveness, we must continue to build stronger bridges between research, innovation, and entrepreneurship.

Copenhagen Fintech remains the meeting point of this community and the largest centre for Nordic fintech, with Nordic Fintech Week as the stage: broader in scope, deeper in content, and more international in reach than ever, reflecting the strength and maturity of the ecosystem.

Looking ahead, the Nordic Fintech Center represents the next step: a new, research-driven partnership platform designed to strengthen talent, deepen collaboration between academia and industry, and accelerate the creation of the next generation of fintech startups across Denmark and the Nordics.

At the same time, long-term thinking becomes essential. Through initiatives such as the Future Scenarios Report developed with PA Consulting, we connect Nordic and European perspectives with global thinking—at a moment when finance, technology, and geopolitics are increasingly intertwined. And as fintech companies scale, robust governance and proactive board engagement are recognised as critical forces for resilience, responsibility, and sustainable value creation.

The lesson of the past ten years is clear: progress in fintech is built block by clock, together.

So let’s keep building the next ten years, together.

.jpeg)